maryland student loan tax credit reddit

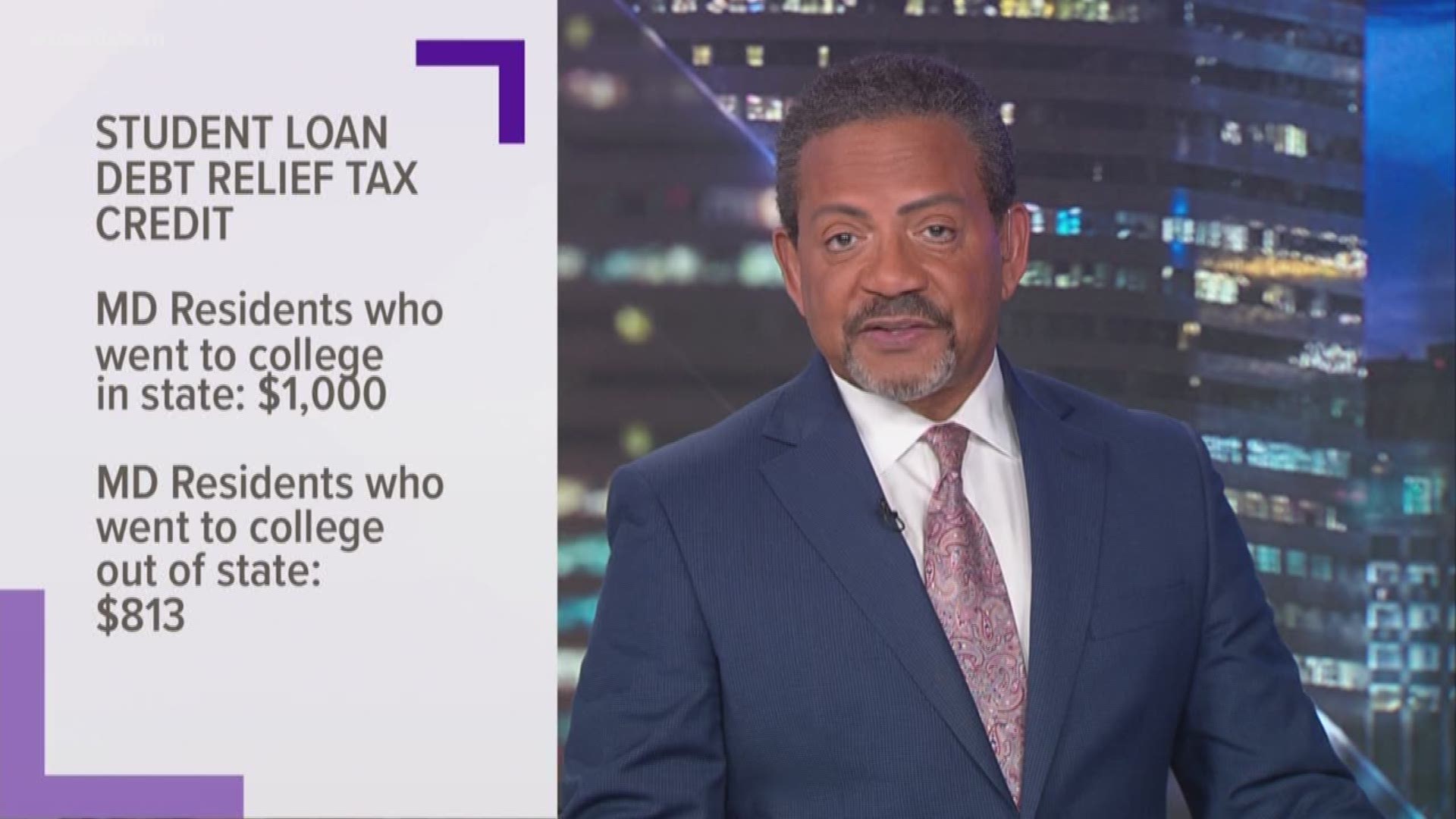

This year was my first time applying the deadline was September. Maryland Student Loan Debt Relief Tax Credit.

Student Debt Cancellation Stands Its Best Chance Yet But Would It Advance Social Justice

From the Office of the Maryland Comptroller.

. I got mine today it seems my credit amount will be 883. More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017. Maryland taxpayers who have incurred at least 20000 in undergraduate andor.

23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept. How much money is the Maryland Student Loan Debt Relief Tax Credit. I probably spent that in billable hours applying for the thing so Im a.

To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were. Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit. It was established in 2000 and is an active member of.

From some research I did. Has anyone applied for this maryland tax credit for student loans. The tax credit has to be recertified by the Maryland State government every year so its not a guaranteed credit each year.

Very early for this they dont even have all of the information up yet but I used this for my 2017 taxes and got 1200 to put toward my student loans. Filed 2022 Maryland state income tax. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in.

Anyone received their student loan tax credit amount notification. Maryland Student Loan Tax Credit. Great program and easy to apply if you are eligible.

Enter the total level of tax credit up to 5000 being claimed based upon the total eligible undergraduate student loan debt balance. Student Loan Debt Relief Tax Credit. 15 to apply for a Student Loan Debt Relief Tax.

At least 5000 in outstanding student loan debt upon application for the tax credit. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Student loan debt relief tax credit program.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Eligible people have until Sept. CuraDebt is a debt relief company from Hollywood Florida.

If the credit amount is used to repay student loan debt within the two-year time period there will be no Maryland income tax due as a result of the Maryland Student Loan Debt Relief Tax. Maryland taxpayers who maintain Maryland residency for the 2022 tax year who have incurred at least 20000 in undergraduate. Maryland r esidents looking to claim student loan debt relief must do so in less than two weeks.

Complete the Student Loan Debt Relief Tax Credit application. The full amount of credit can be up to 5000 I believe and you. With more than 40 million distributed through the program.

About the Company Maryland Student Loan Debt Relief Tax Credit Reddit. Incurred at least 20000 in student loan debt. Maryland Student Loan Tax Credit Reddit.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at. Going to college may seem out of reach for.

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Reddit User Shocked After 400 000 Mysteriously Appears In Bank Account Daily Mail Online

Can Reddit Be Used For Cheating Everything You Need To Know Scamfish A Consumer Protection Publication Socialcatfish Com

Some States Could Tax Biden S Student Loan Debt Relief

Every Electric Vehicle Tax Credit Rebate Available By State

9m In More Tax Credits Available For Maryland Student Loan Debt R Umd

Stolen From Reddit The Masters To Sit For The Cpa Fishbowl

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

Student Loan Financial Advisor For Doctors White Coat Investor

The Best Tool For Tax Planning Physician On Fire

If You Live In Maryland Apply For This Government Money To Pay For Student Loans R Studentloans

What Is Credit Card Churning And How To Manage Them

Everything You Need To Know About How A Reddit Group Blew Up Gamestop S Stock Cnn

How Much Do Doctors Make Salary By Specialty 2022 White Coat Investor

If You Live In Maryland Apply For This Government Money To Pay For Student Loans R Studentloans

Reddit And Violent Speech Can Hate Be Banned Huffpost Latest News

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Governor Larry Hogan Official Website For The Governor Of Maryland